Join this month for a chance to win 1 of 3 pairs of AirPods. Join Now

Attend a free online retirement planning workshop. Register

Join this month for a chance to win 1 of 3 pairs of AirPods. Join Now

Attend a free online retirement planning workshop. Register

RTOERO TORONTO DISTRICT 16 SPRING LUNCHEON & ANNUAL MEETING WEDNESDAY, MAY 22, 2024 REGISTRATION FORM Old Mill (centre): […]

The Foodie Hotspot Lunch Group! Spring & Summer Program Interested in exploring new dining establishments, regional cooki […]

RTOERO Toronto’s New Social Club The 2SLGBTQIA+ Social Club!! Join us for conversation and make new friends in a suppor […]

RTOERO Toronto District 16 Presents SPRING & FALL THEATRE TRIPS RTOERO Members of all Districts and Friends Welcome Downl […]

The Toronto Choristers are pleased to announce their Spring Concert, 2024 May 15, 2024 Jubilee United Church 40 Underhill Dr. […]

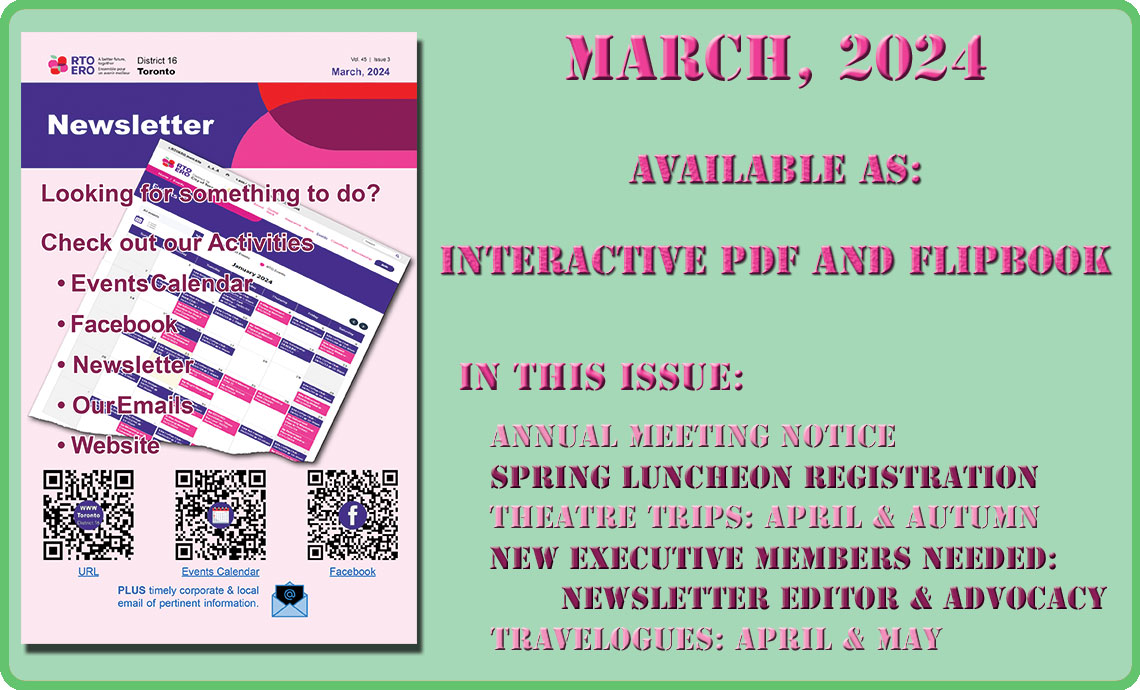

The RTOERO Toronto District MARCH, 2024 Newsletter Items included: Annual Meeting details; Spring Luncheon notice & Regis […]

The Toronto Newsletter editor is vital in helping RTOERO Toronto District 16 keep in touch with its members. Being a member o […]

HEALTH AND WELLNESS WORKSHOPS All Members and Friends are Welcome Join us in April at our wellness series as we explore vario […]

HOSTED BY SPONSORED LOCALLY BY TELL YOUR FRIENDS IN THE EDUCATION SECTOR Retirement is one of the most signific […]

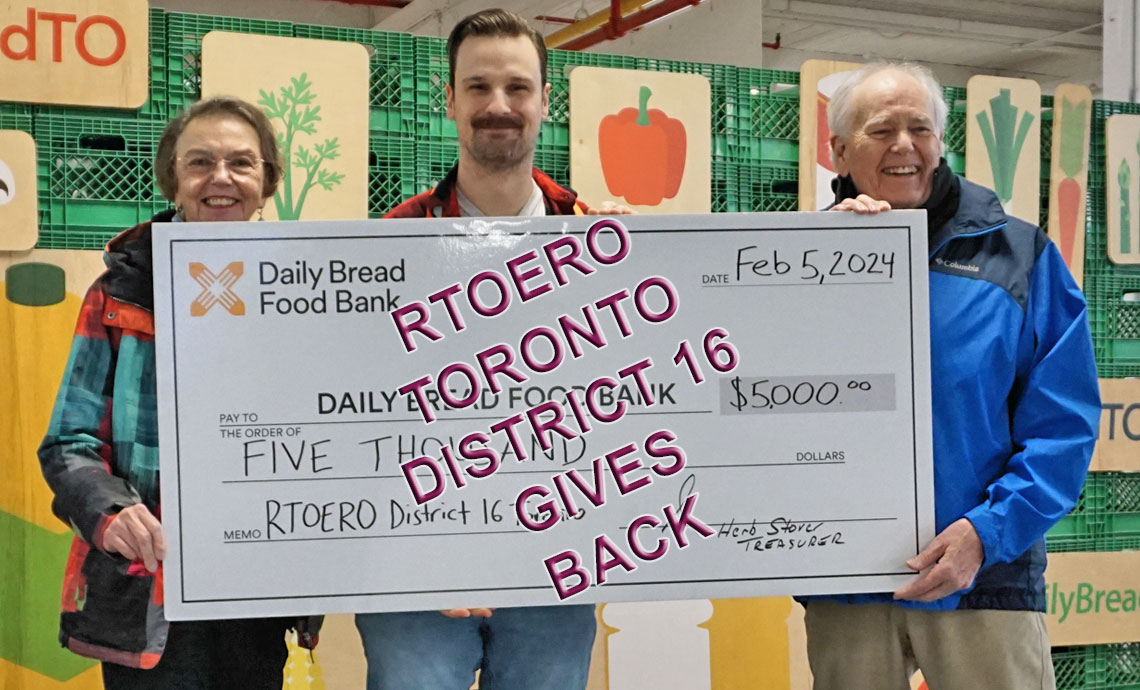

_ On behalf of its members, the RTOERO Toronto District 16 Executive made a $5,000 donation to the Daily Bread Food Bank. Pho […]

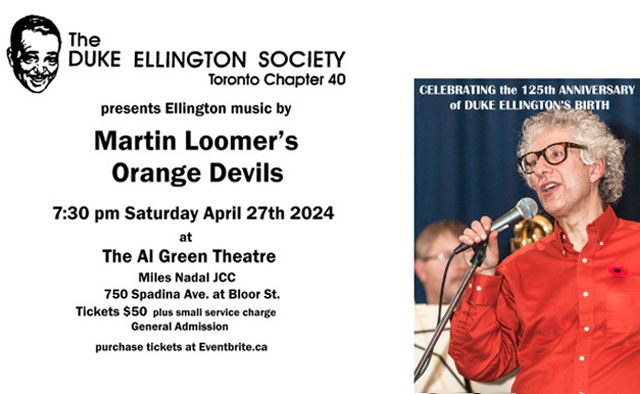

____ ____presents Ellington Music by __-Martin Loomer’s __**Orange Devils 7:30pm Saturday April 27 2024 The Al Green Th […]

View our Activities Calendar via the Events Tab Download a list of our activities for reference. […]

Heather Talbot is the Executive Member who liaises with our activity convenors. If you have an interest in being the host for […]

RTOERO Toronto Districts 16 Executive ~ 2023 – 2024 RTOERO Toronto District Government Document (PDF) Term of Office: J […]

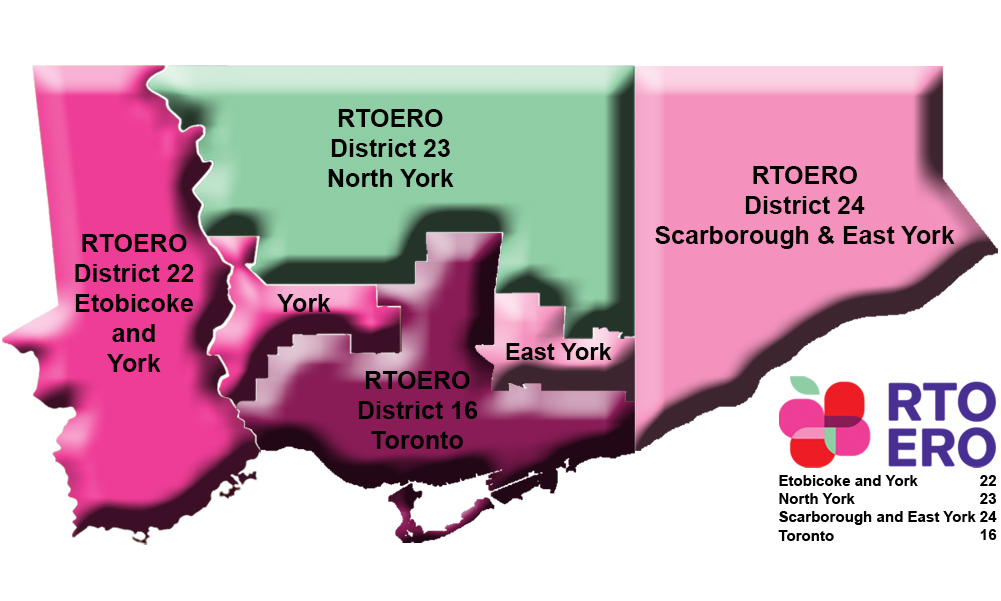

The four RTOERO Districts in Toronto have the legacy names of Metropolitan Toronto prior to amalgamation in 1997. Our four di […]

RTOERO and Toronto District 16 has a long history of serving Toronto Education Retirees and the many who join us having moved […]

RTOERO offers an annual scholarship program and awards scholarships valued at $3,000 each. Twenty post-secondary students are […]

The Formation of Districts The first Senate Meeting of The Superannuated Teachers of Ontario (STO) met in March 1968. Represe […]